Start & Grow Your U.S. Business – Hassle-Free

LLC & Tax Services!

We handle everything from LLC formation to EIN, ITIN, and tax filing, so you can focus on growing your business with confidence!

Trusted by over 10,000 entrepreneurs from 100+ countries.

Smart Solutions for Entrepreneurs

LLC Formation Made Simple

Turn your business idea into a U.S. company with ease.

We handle the paperwork, legal steps, and setup so you can focus on building — not stressing.

- Hassle-free LLC setup tailored to your business goals

- Fast EIN & ITIN applications for smooth operations

- Step-by-step guidance to launch your business in the U.S.

- Your U.S. journey starts here.

Taxation & Compliance for LLC Owners

Already have an LLC? Let’s keep it compliant and penalty-free.

From federal tax returns to annual reports, we ensure your company stays in good standing year after year.

- Accurate and timely Federal Income Tax Return filing (1120, 1065, 1040-NR)

- Annual State Reports to maintain active status

- Ongoing compliance support to minimize risks and avoid penalties

- Stay compliant. Stay protected

Trusted by over 10,000 Affiliate Partners

WHAT WE DO ?

Our Services

LLC Formation

Whether launching a new venture or running an established business, let us handle the EIN registration effortlessly, saving your time and frustration.

LLC Dissolution, Amendments, and Reactivation

Whether you’re updating your LLC, temporarily pausing operations, or closing it entirely, we’re here to streamline the process.

IRS Federal Income Tax Returns

When it’s time to file your taxes, navigating the process can be overwhelming. With trusted tax preparation services, you can ensure that your IRS tax return is filed correctly.

EIN

Whether launching a new venture or running an established business, let us handle the EIN registration effortlessly, saving your time and frustration

ITIN

We help individuals, freelancers, and small business owners secure their ITIN Application efficiently while ensuring full compliance with U.S. tax laws.

Payment Gateways

Setting up financial accounts like PayPal, Wise, or a bank account can be daunting. With our professional services, you can ensure your accounts are set up quickly.

Trademark Registration

When you decide to register your logo or name, you’re not just complying with the law, you’re protecting your hard-earned business identity.

Amazon Account

Setting up financial accounts like PayPal, Wise, or a bank account can be daunting. With our professional services, you can ensure your accounts are set up quickly.

Sales Tax Permit

When it’s time to file your taxes, navigating the process can be overwhelming. With trusted tax preparation services.

BOI Report

File your Beneficial Ownership Information Report with FinCEN to avoid serious penalties.

LLC Annual Report Filings

Whether you’re updating your LLC, temporarily pausing operations, or closing it entirely, we’re here to streamline the process.

Comparison

Consultancy vs them

Startup Consultancy’s affordable, comprehensive services make it the top choice for non-resident entrepreneurs.

US Business Formation

$199

$399

$399

$399

$399

Registered Agent

EIN

BOI Report Filing

+50

$100

$100

$100

$100

Operating Agreement

Free Tax Consulting

24/7 Support

Annual Compliance Filing

$50 + State Fee

not offered

$150 + State Fee

$150 + State Fee

$150 + State Fee

Total

$250+State Fee

$449+State Fee

$649+State Fee

$449+State Fee

$397+State Fee

Price Comparison

You Save $249

$249 more costly

$299 more costly

$199 more costly

$147 more costly

HOW IT WORKS

Here’s how Startup Consultancy can help you launch your business swiftly!

Submit Your Application

Fill out your personal & company details using our online form.

We File for You

We’ll handle the paperwork submission for your business and file the EIN number on your behalf.

Get your Business Documents

We provide your business papers, such as your business formation certificate and employer identification number (EIN), directly to your customized dashboard.

Open your Bank Account

We’ll guide you open bank account, allowing you to begin your business operations.

Our Testimonial

What Our Customers Said?

Our international assistance has empowered entrepreneurs from diverse backgrounds to launch their businesses in the United States.

4.9

24,098 reviews • Excellent

Consumer

- 2 Review

- PK

Aug 16, 2025

Great help and services by Startup Consultancy. They work very professionally and make it easy to understand all the flows of taxation. I truly admire their work and recommend everyone to consult them for understanding, managing, and filing taxes smoothly with Startup Consultancy.

Umer Manzoor

- 1 Review

- AE

Aug 9, 2025

I recently used a startup consultancy for my Zyla Bank account tax return, and I’m truly impressed with their service. The team was extremely kind, professional, and supportive throughout the process. They understood my issue quickly and resolved it on time without any hassle. I highly recommend them to anyone looking for reliable and friendly consultancy services.

Attique Ur Rehman

- 1 Review

- PK

Jul 24, 2025

10000% recommended one of the best, reasonable and reliable agency in pakistan.

Rao Shahid

- 1 Review

- PK

Jul 23, 2025

I’m the Proprietor of Rhinodesigners, and I recently obtained my LLC and ITIN through Startup Consultancy. The process was smooth, fast, and highly professional. Their team guided me every step of the way, making everything easy to understand and stress-free. I highly recommend Startup Consultancy to anyone looking to start their business in the U.S. — reliable and efficient service!

Fahim Shahriar Hridoy

- 1 review

- BD

Apr 15, 2025

I recently used their service for filing my federal tax return, and I was really impressed with how quickly and efficiently they handled everything. The entire process was smooth, and their customer service team was very friendly and supportive throughout. I’m very happy with the overall experience!

mujtaba shafiq

- 14 Review

- PK

Apr 10, 2025

Amazing Experience with Startup Consultancy!**

“I was dreading tax season for my US based LLC, but startup consultancy made the process effortless! Their team was professional, knowledgeable, and incredibly responsive. Specially Mr. Ashfaq is a very helpful person. They took the time to explain everything clearly and helped me.

Mohsin Razzaq

- 1 Review

- PK

Apr 10, 2025

Compliance Help

- 1 Review

- PK

Apr 9, 2025

I had a great experience working with Startup Consultancy. They helped me with filing my federal tax reports, and I couldn’t be more satisfied with their service. Their team guided me through the entire process on a call, explaining everything in clear, simple terms. I appreciated their patience and thoroughness, ensuring I understood every step. I felt confident and well-supported throughout the entire process. Highly recommend their services for anyone looking for reliable and knowledgeable tax assistance!

Abdul Haq

- 1 Review

- PK

Apr 8, 2025

. In January 2023, I formed my LLC with the help of Start Up Consultancy, and I continue to manage all my filings through their services. The team is very cooperative and sincere, always responding quickly and providing free consultations with great professionalism.

Abdul Haq LLC

James Mello

- 2 Reviews

- GB

Apr 7, 2025

Very professional, great response time and these guys know what they are doing!

Recommended, i would say best out there compared to other consultants.

Ziyad Jamil Hussain

- 1 Review

- PK

Apr 6, 2025

I had a great experience with Startup Consultancy. Their service was quick and they helped me with filing and preparing all the needed documents. I’ll definitely use their services again in the future. Highly recommended!

Salman Saghar

- 2 Reviews

- PK

Apr 6, 2025

Very friendly and responsible team, my 1st experience is very nice.

Recommended to everyone who want their return files on time to IRS.

Now i am your permanent client, best accountant in Pakistan..!

Sajid Mehmood

- 1 Review

- PK

Mar 25, 2025

I had a fantastic experience with Startup Consultancy for U.S. Business for my tax filing! Their team made the process simple and stress free, handling everything professionally and accurately. They were always

available to answer my questions and ensured I met all deadlines without any hassle.

I highly recommend their services to anyone looking for a reliable and efficient tax filing solution. I will definitely use them again next year

Sanju Paras

- 1 Review

- PK

Mar 23, 2025

“l had the pleasure Of working with this incredible team for some USA taxation and LLC-related services, and I must say, they exceeded all my expectations. The team is highly skilled and knowledgeable in US taxation, providing expert guidance every step of the way. What truly sets them apart is their honesty and transparency—they really care about their clients’ SUCCeSS and make Sure you’re fully informed throughout the process. I highly recommend them to anyone needing assistance with US taxation or LLC-related matters. A truly professional and reliable team!”

Sanju Paras

- 1 Review

- PK

Mar 18, 2025

Amazing experience filing my LLC taxation with Startup Consultancy Highly professional and knowledgeable.

My EIN number was fake allotted by my previous accountant causing me major issues however they sorted it out for me as a kind gesture. Highly Recommended

Syed Shah Raza

- 1 Review

- PK

Jan 9, 2025

Amazing experience filing my LLC taxation with Startup Consultancy Highly professional and knowledgeable.

My EIN number was fake allotted by my previous accountant causing me major issues however they sorted it out for me as a kind gesture. Highly Recommended

Startup Consultancy

Find the Entity That's Right For You

Consultancy will guide you through the process. Use our resources to select a business formation type.

- Did you know LLCs are the most popular choice for startups?

Limited Liability Companies (LLCs)

Flexibility & Operational Ease

LLCs offer unmatched simplicity, making them ideal for entrepreneurs who want a smooth setup process with minimal bureaucracy.

Ownership & Management

No restrictions on the number of owners. Flexible management structures allow businesses to tailor operations to their unique needs.

Taxation Advantages

LLCs benefit from pass-through taxation by default, with the option to elect corporate taxation—providing members with greater tax flexibility.

Liability Protection

Personal assets are safeguarded from business debts and obligations, making LLCs a secure choice for entrepreneurs managing higher-risk ventures.

Compliance Requirements

Moderate compliance standards apply. Some states may require reformation or amendments when ownership structures change.

Financing Options

LLCs are commonly funded through member contributions and bank loans, though attracting outside investors can be more challenging.

Best Suited For

Entrepreneurs and startups who value flexibility, asset protection, and tax advantages—particularly in industries with higher liability risks.

S-Corporations (S-Corps)

Flexibility & Operational Ease

S-Corps balance the benefits of corporate structure with operational flexibility, though they require certain formalities to maintain tax status.

Ownership & Management

Limited to 100 shareholders, all of whom must be U.S. residents—this restriction can limit investment opportunities compared to other structures.

Taxation Advantages

Enjoys pass-through taxation, avoiding double taxation. S-Corps also allow strategic tax planning through a combination of salaries and dividends.

Liability Protection

Shareholders’ personal assets remain protected from company debts and obligations, safeguarding personal wealth.

Compliance Requirements

Must follow strict IRS eligibility rules and adhere to operational guidelines and reporting standards to maintain S-Corp status.

Financing Options

S-Corps can raise funds through a single class of stock and loans, but options are narrower than those available to C-Corps.

Great Choice For

Small to medium-sized businesses that meet IRS requirements and want the tax benefits of pass-through treatment without the complexities of a C-Corp.

C-Corporations (C-Corps)

Flexibility & Operational Ease

C-Corps operate under the most complex structure, requiring strict regulatory compliance and governance—best suited for businesses prepared to manage these demands.

Ownership & Management

No limits on the number of owners or their nationality, making C-Corps an attractive option for global investment and large shareholder bases.

Taxation Advantages

Subject to corporate taxation, with the possibility of double taxation on dividends. However, C-Corps benefit from a broader range of deductible expenses.

Liability Protection

Provides the highest level of personal liability protection, making it ideal for companies with significant operational or financial risk.

Compliance Requirements

Requires extensive record-keeping, governance practices, and shareholder meetings, aligning with large-scale or publicly traded businesses.

Financing Options

Unmatched capital-raising potential through public and private stock offerings, giving access to substantial investment opportunities.

Great Choice For

Established companies or businesses planning to go public that require maximum growth potential, investor appeal, and strong liability protection.

Non Profit

Flexibility & Operational Ease

Non-profits operate under strict regulations that prioritize mission-driven goals over operational flexibility, ensuring alignment with charitable purposes.

Ownership & Management

Unlike traditional businesses, non-profits have no owners. They are governed by a board of directors that oversees operations and ensures the mission remains the focus.

Taxation Advantages

Eligible for tax-exempt status, allowing them to avoid most forms of taxation and enabling donors to make tax-deductible contributions.

Liability Protection

Provides strong liability protection, keeping personal assets separate from organizational obligations—a critical safeguard for charitable operations.

Compliance Requirements

Subject to non-profit-specific rules, reporting, and audits, ensuring transparency, accountability, and compliance with regulations.

Financing Options

Primarily funded through donations, grants, and fundraising activities, with resources dedicated to advancing the organization’s mission rather than generating profit.

Great Choice For

Charitable, educational, religious, or scientific organizations aiming to create social impact while benefiting from tax exemptions and public trust.

Startup Consultancy

Flexible Pricing That Aligns With Your Needs

Trust our experts to navigate and set your business up for success.

- Basic

$99

+ State Fees

- What’s included

- LLC Formation

- EIN Application

- Address Services

- Standard

$199

+ State Fees

- What’s included

- Registered agent

- Shared business address

- Article of organization

- Certificate of filling

- Certificate of formation

- EIN

- Business bank account guidance

- Personal dashboard to track progress

- 24/7 customer support

- Premium

$299

+ State Fees

- What’s included

- Registered agent

- Unique business address

- Article of organization

- Certificate of filling

- Certificate of formation

- Operating agreement

- EIN

- Business bank account setup

- BOl report filing

- Personal dashboard to track progress

- 24/7 customer support

- 1 year free tax consultation

- Dedicated account manager

Startup Consultancy

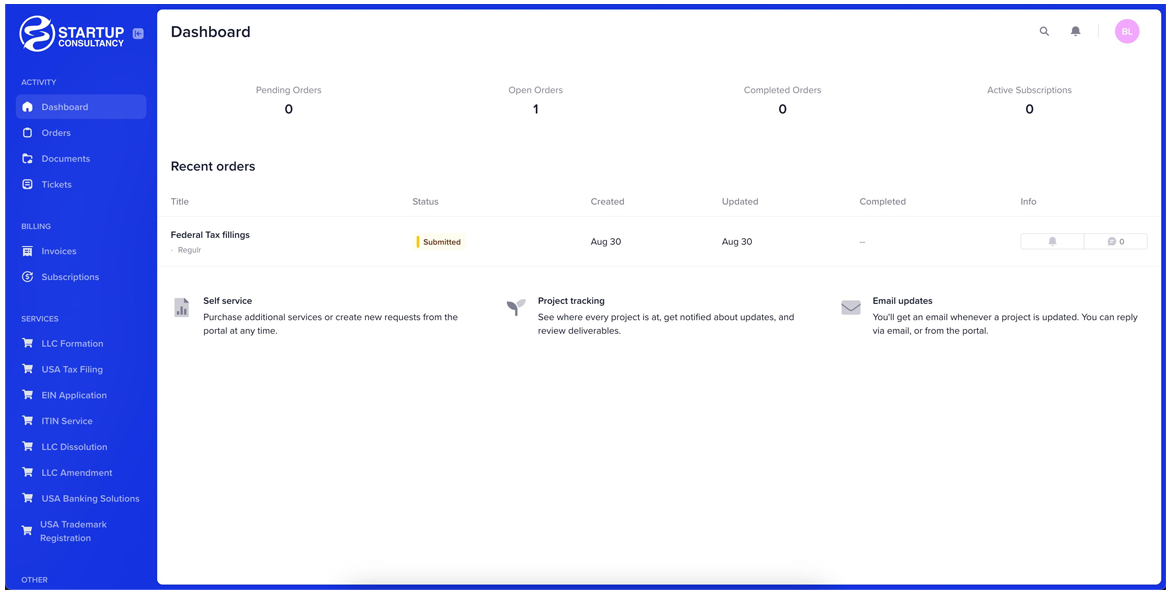

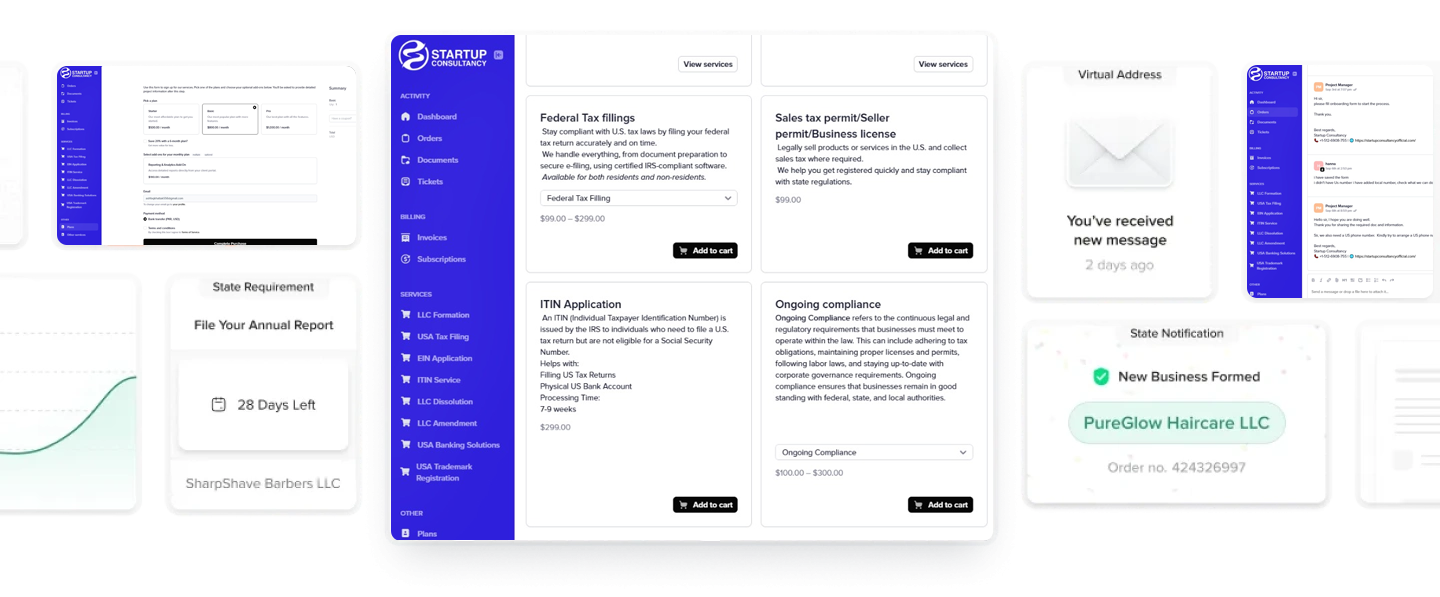

Your Personalized Dashboard

Everything you need: Business essentials and reminders in one place.

Customer support is our priority

We put customers first. That means when you need to talk to a human, you can reach a human.

Real help from real people

Industry Leading Service

English and Spanish-speaking

Excellent 4.6 out of 5 (21,961 Reviews)

Why do over 1,000,000 businesses trust Startup Consultancy?

Rao Shahid

- 2 Reviews

- US

Jul 23, 2025

I’m the Proprietor of Rhinodesigners, and I recently obtained my LLC and ITIN through Startup Consultancy. The process was smooth, fast, and highly professional. Their team guided me every step of the way, making everything easy to understand and stress-free. I highly recommend Startup Consultancy to anyone looking to start their business in the U.S. — reliable and efficient service!

Syed Shah Raza

- 1 Reviews

- PK

Jan 9, 2025

I needed LLC for my new startup, so i contacted them. One of the first and best feature was their 1 on 1 free consultation. The experience was very smooth, very professional team with best responses and on time delivery.

Highly recommended to anyone who wants to start their business but don’t have any lead.

SANJU PARAS

- 2 Reviews

- PK

Mar 23, 2025

“I had the pleasure of working with this incredible team for some USA taxation and LLC-related services, and I must say, they exceeded all my expectations. The team is highly skilled and knowledgeable in US taxation, providing expert guidance every step of the way. What truly sets them apart is their honesty and transparency—they really care about their clients’ success and make sure you’re fully informed throughout the process. I highly recommend them to anyone needing assistance with US taxation or LLC-related matters. A truly professional and reliable team!”

Startup Consultancy

Explore Trending Topics

Stay updated with the latest insights on business formation, tax strategies, and compliance. Our expert articles help you make informed decisions with confidence.

Startup Consultancy

Frequently Asked Questions

Our international assistance has empowered entrepreneurs from diverse backgrounds to launch their businesses in the United States.

How long does it take to set up an LLC or LTD?

Setting up an LLC or LTD typically takes 7–14 business days, depending on the state or jurisdiction. However, expedited processing is available in some cases.

What documents do I need to provide for business formation?

You will generally need a government-issued ID, business name, registered agent details, and any specific documents required by your state or country. Our team will guide you through the exact requirements.

What happens if I miss filing my BOI report or annual reports?

Missing these filings can result in penalties, fines, or even business suspension. We can assist you in catching up with any missed filings and ensuring future compliance.

How do I dissolve my LLC or make amendments to it?

We guide you through the process of dissolving an LLC or making amendments to existing documents. This includes preparing and filing the necessary paperwork with the appropriate authorities.

What’s the process for reactivating a dissolved business?

Reactivating a dissolved business involves filing the required reinstatement documents, paying any overdue fees or penalties, and ensuring compliance with current regulations. We handle this entire process for you.